Podcast | Exploring the trend of disruptor banks in search

08 May 2019

Exploring the trend of disruptor banks in search

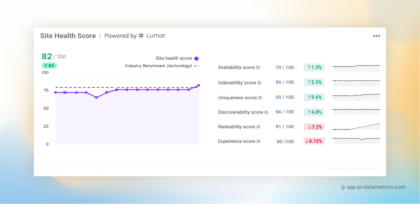

As disruptor banks have grown in search by 32% from Jan 2016 to Jan 2019, this month we discuss how fintech and disruptor banks are changing our banking habits online.

We explore:

- The success of challenger banks in search

- How disruptive these banks really are

- How traditional banks perform online

- ...and what traditional banks can learn from challengers

Listen on Apple podcasts and Spotify.

For more insights on the rise of digital disruptors, download the full challenger bank report.

[icon-cta-banner colour='jazzberry-jam' headline="Disruptor banks report" icon='/wp-content/uploads/2018/10/banking-icon_white_150X150-outline-white.svg' cta_action='/resources/market-performance-reports/rise-challenger-banks-search/' cta_text='Download now']

[/icon-cta-banner]

AI Transcription

This podcast has been transcribed using an AI transcriber. There may be some errors and this is not a substitute for listening to the episode.

Emily Hogarth 0:03

Hi, you're listening to elevate search, from Pi Datametrics with me, Emily Hogarth,

Louise Linehan

And me, Louise Linehan,

EH

Where we explored the expansive benefits of search intelligence.

LL

This month, we are looking at how FinTech and disruptive banks are changing our banking habits online, focusing on the success of disruptor banks in search, the decline of traditional banks online, and what traditional banks can do online to stay abreast of these changes.

EH 0:30

So what are challenger banks?

LL

Challenger banks are smaller, fairly young retail banks that are competing with the longer established traditional banks specializing in digital banking and introducing new financial management features.

EH

So banks like Revolut and Monzo,

LL

Yeah, that kind of thing. They're pretty successful at the moment. And there's a couple of reasons as to why that might be.

EH 1:00

Yeah, so everything they're doing is reflecting the modern world and therefore, I think attracting a younger generation. So not only are they adding features that are opening up banking and finance in a new way, but they're also demystifying the whole process and their whole business. Many are fully digital and app based. They're even investing in things they users care about. So much like we might use our clothing to communicate who we are, these banks are actually feeding into the younger generations identity.

LL

Yeah. And I think that's largely because of things like the 2008 financial crisis, we all lost a lot of faith in banks, there's a bit of a lack of clarity. And these new banks are really focused on transparency, like you said, embracing also new technologies. And they're also so much more socially and ethically responsible than their predecessors, and actually need to be as well because if they're going to hope to meet the demand of these new generations, these younger generations, that's what they care about. So it's quite important.

EH 2:00

Yeah, and it's definitely paying off because Monzo now accounts for 15% of all new current accounts opening in the UK, which is pretty impressive really.

EH

So looking at search, what does this success of challenger banks look like in search?

LL

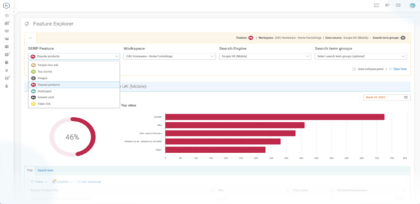

When looking at search volume, the biggest growing disruptor banks in search are all digital only. So that's pretty interesting. Revolut, Monzo and Starling bank are the three leading challenge banks in search volume, but Yolt has seen the most search growth with a staggering 4,715% increase. And that's between 2016 and 2018. They actually only launched in the UK in 2017. So they grew wildly in an even shorter time, and since that launch, they've gained 500,000 customers also pretty impressive. Between the same times 2016 2018 Revolut grew 145%, Monzo has also grown 1136%

LL 3:00

and Starling bank has also grown 1360%. So they've all shot up in the last few years.

EH

This growth will also mean that they need more control and a better understanding of their market and their customers. So as more and more disruptor banks such as Yolt coming to prominence the market is saturating. So you'll need to know where you are and where your competitors are also, when reaching new customers, processes are going to change as they grow. Because in the past, their marketing has been just as innovative as the banks themselves. So for example, Monzo grew their customer base largely through word of mouth. They had a waiting list and then a golden ticket scheme that helped you skip this waiting list and get a bank account. So this gave Monzo a real exclusivity and you know, an edge. They weren't really interested in a big marketing campaign.

EH 4:00

And they didn't need to be because they had such a small customer base. But now that they have a large customer base, they don't have the waiting list anymore. They don't need the golden tickets because there's no waiting list. So they're now looking for more traditional campaigns to reach an even greater audience, and they need those bigger campaigns. So this will inevitably require market and customer data to execute and track such campaigns.

LL

Yeah, and banks such as these can also be using search data in like a broader sense. Many of them are private. So they're not actually on the stock Stock Exchange yet, so they can't as easily see as traditional banks what their value is. So using search volume data as an indicator, they can see where like value lies and interest lies, because search often signifies commercial intent. So for example, if someone was searching Yolt, you could it could be assumed that one day they'd wish to bank Yolt. So yeah, disruptors can

LL 5:00

use search intelligence, much like they would use stock market data to see the value in the public domain.

EH

Yeah, like for example, if a disruptor bank was declining in search, it can be assumed that their brand value is also declining.

LL

Exactly.

EH

So are these banks as disruptive as we're led to believe?

LL

Well, if we look at traditional banks in search, it's undeniable, they are still huge. In March alone of this year, there was 16 million searches for all of the leading traditional banks. And in the same month for all of the leading disruptor banks, there was only 2 million So a really large gap. But we can also see there's definitely decline in traditional banks in recent years. In fact, traditional banks are falling in search volume by 22%, from January 2016 to January 2019.

EH

It's important to note that challenge banks aren't actually offering the same as traditional banks. So traditional banks are offering current accounts, credit cards, insurance,

EH 6:00

mortgages. And most challenger banks are really only offering current accounts and maybe credit cards. But because of this difference in offering many users of challenger banks are also still using traditional banks for the features that challenger banks aren't offering so they can get the best of both worlds. So they're not actually dropping traditional banks.

LL

So yeah, there's definitely still opportunity there for traditional banks, because disruptor banks are still in the initial stages of targeting net new customers new audiences. So there's still opportunity for traditional banks to capitalize on this.

EH

Yeah, but despite that, there's still a fear from traditional bank. So a recent survey by FinTech provider Fraedom found that 86% of bankers believe challenger banks were a growing threat to their business.

LL

So what can traditional banks do to remain competitive alongside these fast moving disruptors?

EH

there are definitely things a traditional bank can do to stay

EH 7:00

relevant and compete, it can be hard to change and transform digitally. When you've got such a long standing infrastructure and processes, it's really important to have a carefully planned strategy in place.

LL

Yeah. So recently, there's one example where a bank didn't actually do this so well. So Halifax completely copied Mozo’s banking layout recently, to such an extent that they didn't even change the number on name on the virtual card. Something that Monzo spotted and then call them out for online on social media. The name of my card was actually the name of a Monzo employee. So it just goes to show that disruptor banks are threatening traditional banks. And they're kind of scrambling to keep up with them. So yeah, it really isn't enough to just copy challenger banks. There are smarter way to transform to fit in with this. Rising FinTech and one of the most important things is having data to understand

LL 8:00

What is important to your audience and really getting to grips of your customer. So by integrating search intelligence and other customer focus data sets, you can identify where people's financial interests lie and build a profile of your customers to inform things like marketing, r&d. And once you've identified those interests, you can optimize your site and tracks those new customers.

EH

Yeah, and search is especially important for new business. Because as digital banking is taking place on apps, mostly, the people searching online, are most likely researching. So being able to capture those researchers at this time is imperative for them maybe later signing up for you. So having your site optimized for the relevant terms is really essential.

LL

So from a search intelligence perspective, if you had one golden tip, the traditional bands looking to stay competitive in the face of disruptors, what would it be?

EH

Well, you can actually potentially use search data to find an appropriate partner to

EH 9:00

propel you into the digital banking arena. So, as an example, Goldman Sachs partnering with Apple to create Apple card, Apple is such a huge name in tech, it was very shrewd of Goldman Sachs to partner with them because the younger generation, you know, millennials, Gen Z, they are completely bought into Apple tech. So they are only really thinking about Apple and not thinking about the traditional bank behind it. So as new banking is completely tied up in tech, we, I think can anticipate seeing more of this sort of partnerships. So you could use a share of voice chart to see who's in that arena online and make an informed decision.

LL

So I think my top tip would be start by monitoring the communities that digital disruptors have generated for feature suggestions and banking suggestions and offerings by customers, and then I would probably look to

LL 10:00

tracking these trends in social media and search to see which ones are gaining momentum, and then I would perhaps feed this back into my r&d and marketing to get that competitive advantage.

LL 10:15

If you liked what you heard today and want to see a deeper dive into how the UK banking search landscape is changing, download our banking report in the link below.

EH

Please subscribe on iTunes and follow us on Twitter, Instagram, Facebook, and LinkedIn @pidatametrics.

LL

Thanks for listening and have a great week.

Want to be a guest on the Elevate Search podcast?

If you’ve got a search intelligence topic you think Elevate Search listeners may be interested in, please get in touch!

[icon-cta-banner colour='jazzberry-jam' headline="Disruptor Banks report" icon='/wp-content/uploads/2018/10/banking-icon_white_150X150-outline-white.svg' cta_action='/resources/market-performance-reports/rise-challenger-banks-search/' cta_text='Download free']

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.